Understanding the Basics of Pour Over Will

A pour-over will is a type of will used in conjunction with a trust. It is designed to “pour” any assets that are not already in the trust at the time of the testator’s (the person creating the will) death into the trust, to be managed and distributed according to the terms of the trust. Contact a lawyer and schedule a free initial consultation for guidance.

Here are some things you should know about pour-over wills:

- Pour-over wills are used in conjunction with trusts.

A pour-over will is not a standalone document but is used in conjunction with a trust. The trust specifies how the testator’s assets should be managed and distributed after their death, and the pour-over will serve as a way to transfer any assets that are not already in the trust at the time of the testator’s death into the trust.

- Pour-over wills are revocable:

Like other types of wills, the testator can amend or revoke pour-over wills at any time during their lifetime as long as they are competent to do so.

- Pour-over wills can help to avoid probate.

Because the assets in a trust do not have to go through the probate process, a pour-over will help to avoid the time and expense of probate for any assets that are not already in the trust at the time of the testator’s death.

- Pour-over wills should be kept with the trust.

It is important to keep the pour-over will with the trust documents to easily locate it after the testator’s death. If the pour-over is not located, it may be considered invalid.

- Pour-over wills should be clearly written.

For a pour-over will to be effective, it must be clearly written and easy to understand. This is important because, in the event of a dispute over the terms of the will, the court will need to be able to interpret the testator’s wishes accurately.

- Pour-over wills should be updated regularly.

It is a good idea to review and update your pour-over will and trust regularly to ensure that they reflect your current wishes and circumstances. This is especially important if you experience significant life changes, such as getting married or divorced, having children, or acquiring additional assets.

- It is generally a good idea to seek the advice of an attorney:

While it is possible to create a pour-over will on your own, it is generally a good idea to seek the advice of an attorney to ensure that your will is properly executed and that all of your wishes are clearly expressed. An attorney can also help you understand the laws in your state and determine whether a pour-over is the most appropriate option for you.

Dental Crowns –Restoring Strength, Function, And Aesthetics.

Dental Crowns –Restoring Strength, Function, And Aesthetics.  One-Person Wonder: Making Waves in the Massage Industry in Gunma

One-Person Wonder: Making Waves in the Massage Industry in Gunma  How Cataract Surgery in Nashville Improves Vision and Quality of Life

How Cataract Surgery in Nashville Improves Vision and Quality of Life  Maintaining Oral Health: The Role of Dentists in Richmond

Maintaining Oral Health: The Role of Dentists in Richmond  How to Choose the Best Implant Dentist in Sheffield: A Guide

How to Choose the Best Implant Dentist in Sheffield: A Guide  How Invisalign is Revolutionising Orthodontics in London

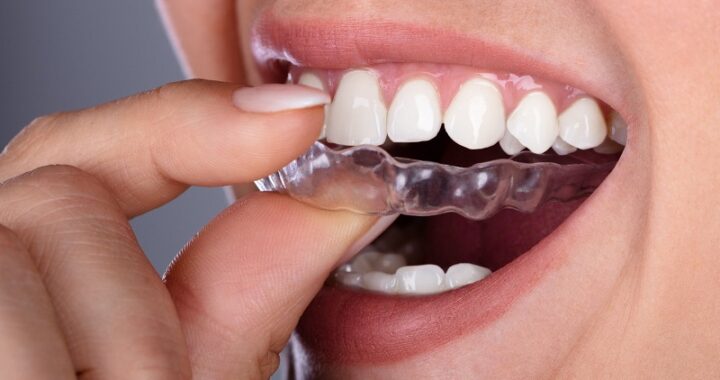

How Invisalign is Revolutionising Orthodontics in London  Veneers: A Popular Cosmetic Solution for a Beautiful Smile in London

Veneers: A Popular Cosmetic Solution for a Beautiful Smile in London