An Essential Guide to Understanding the Benefits of Health Care Financing

In recent years, there has been a great deal of change in healthcare. Nevertheless, such changes could be the beginning of future advancements in medical processes. One choice could provide a way to keep the level of treatment at a certain level even while several medical practices are being pushed to change. To learn more, keep reading.

Medical financial assistance: What is it?

Giving people realistic funding choices for their medical expenses is essential. Medical financing often makes recourse to a patient’s reputation to pay for the cost of any routine treatment. Medical finance is the only method to fill the gap when a patient needs a cure but cannot pay for it right away.

Any patient may find themselves in need of medical funding for an urgent condition as the landscape of healthcare coverage changes. Because of this, your business must provide a health financing alternative. You can also look for medical practices for sale in Florida and work on it in order to improve the healthcare facilities

Protects Patient Access

One of the main concerns for healthcare providers is their ability to provide patients with the appropriate treatment plans and volume of health services. Patients who use financial support have access to affordable options and can get the treatment that would typically be out of their economic range. However, individuals who are impoverished, unemployed, or unable to afford their good insurance usually stop pursuing therapy.

Expand the Patient Base

Flexible payment alternatives ensure availability for consumers who find it difficult to compensate for out-of-pocket health expenses. Furthermore, according to a second Bankrate study, 37% of patients claimed they would skip treatments if their doctor did not provide a patient financing option.

In recent years, choosing a healthcare provider has become more like selecting a supplier in several other consumer-driven industries. Patients now investigate providers online and read the user agreement before choosing one. By creating a patient-focused framework that meets the people they are, practices attract a broader, more diverse patient community.

Lowers the Expense of Collection

Hospitals and private practices incur higher costs under the existing arrangement when patients cannot cover their high medical expenditures. Even large, respectable healthcare organizations can experience the annoyance and expense of collection efforts.

The effort spent on collection removes the modest practices’ higher focus on safeguarding everyone’s health. The hassle that accompanies the procedure of obtaining past due payments may be reduced to a significant extent for medical organizations.

Increases Customer Satisfaction

By providing tools to help people manage their finances, organizations may enhance the connections between patients and healthcare professionals. Patients would be more closely involved in the payment transaction by migrating to a technology-driven, user-friendly interface, which improves their fundamental skills and knowledge.

Patient financing partners might supplement your medical system by taking care of all aspects of the billing process. By providing the patient funding options up front, you may aid in making them feel more understood and encouraged.

Significant Improvement in the Financial Situation

As more consumers recognize themselves without healthcare or cannot afford high premiums, doctor’s facilities are dropping patients. Prospective patients now have the choice to seek treatment even if people are presently unable to afford it. A health facility may retain its economic sustainability by offering customers a financing option.

By discovering why patients aren’t paying their hospital bills, physicians may devise strategies and plan to deal with increasing patient awareness without risking their financial situation.

Dental Crowns –Restoring Strength, Function, And Aesthetics.

Dental Crowns –Restoring Strength, Function, And Aesthetics.  One-Person Wonder: Making Waves in the Massage Industry in Gunma

One-Person Wonder: Making Waves in the Massage Industry in Gunma  How Cataract Surgery in Nashville Improves Vision and Quality of Life

How Cataract Surgery in Nashville Improves Vision and Quality of Life  Maintaining Oral Health: The Role of Dentists in Richmond

Maintaining Oral Health: The Role of Dentists in Richmond  How to Choose the Best Implant Dentist in Sheffield: A Guide

How to Choose the Best Implant Dentist in Sheffield: A Guide  How Invisalign is Revolutionising Orthodontics in London

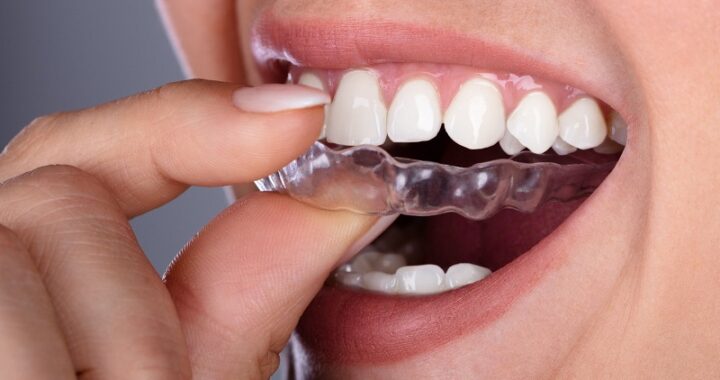

How Invisalign is Revolutionising Orthodontics in London  Veneers: A Popular Cosmetic Solution for a Beautiful Smile in London

Veneers: A Popular Cosmetic Solution for a Beautiful Smile in London